As I was walking the dog yesterday in Florida I passed by a buffet restaurant called the Carving Station. The owner was outside cleaning up the sidewalk and I stopped to listen to him talk. He had a very simple question followed by a message. How come the big restaurant chains get access to the stimulus money and us little guys do not? We serve many more of the needy, we offer prime-rib for $11/meal, and we are more sustainable. We are not a chain, we have been here for forty years, we are closed, and the larger chains get all the help.

How Do We Help Others?

One way we help is the CARES ACT and I have included a lot about that below. But I want to address the equity issue staring us in the face. In school, business, and life, the equity issue is how do we help everyone? In schools we are training teachers to recognize the more subtle indications of poor performance tied to equity, and in this case, the restaurant may not have the manpower to figure out how to get the help that is available. We have already seen some misuse of this federal aid by big stores that have the manpower to figure this out. This is why education, and the need to read, is so important. Digging into government bills to see if you are included in the help they offer is not for the faint of heart. If we are to truly help all of us, we need to look after those that cannot access in an equitable way the learning, the extra money or the services that they need. Let’s get after that. Let’s make sure everyone can read, understand a tax form, read an act of congress, understand jury instructions, and file for unemployment as well as for stimulus money.

US Chamber of Congress

I called the Chamber of Commerce to see what they had to say. They pointed me to their website on the relief package called CARES ACT. Everything below is from their website today. I hope this will help the Carving Station and all of the non-profits in education to get them the help they need. Importantly, you must be pro-active to get these loans. I will drop a copy of this off at the Carving Station.

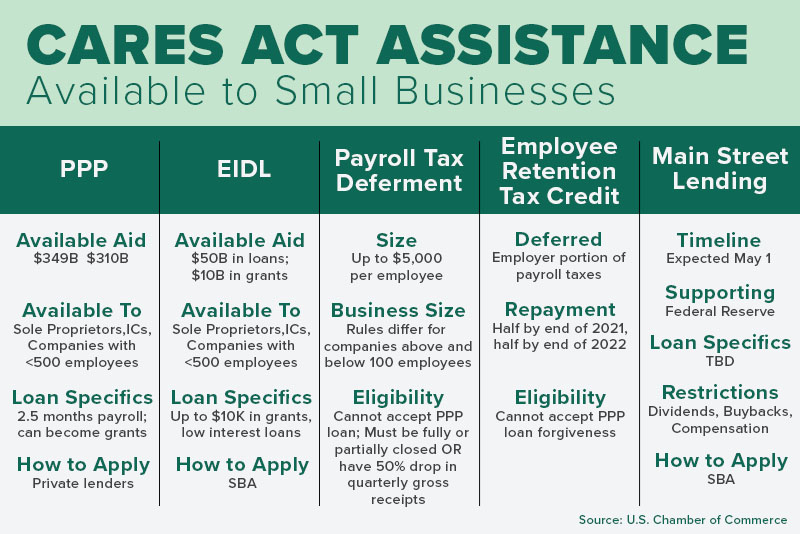

In March Congress passed the $2 trillion-dollar Coronavirus Aid, Relief, and Economic Security (CARES) Act, a stimulus package that includes several programs aimed at small businesses impacted by the COVID-19 outbreak. Demand for the popular Paycheck Protection Program (PPP) has been massive since the application window opened on April 3. The original $349 billion allocated for the PPP ran out in mid-April. On April 24, Congress passed legislation to replenish funds for small business loan programs.

What’s New: The newest legislation will allocate another $310 billion to the PPP and an additional $10 billion to the Economic Injury Disaster Loan (EIDL) grant program. The bill also includes $60 billion for other economic disaster loans for small businesses, with half of that amount reserved for community financial institutions and smaller banks and credit unions.

—U.S. Chamber of Congress

Wondering what new programs you should apply for? Unsure how to apply? Read on.

What Loan Program Should I Use?

Although the PPP has been the most popular loan program for small businesses, it may not be the right solution for every business. Be sure to check out other loan options from the Small Business Administration (SBA), other federal loan programs, and organizations and companies providing grant money.

—U.S. Chamber of Congress

Here are some new federal programs aimed at helping businesses impacted by coronavirus:

Paycheck Protection Program (PPP): This has been the most popular option for small business owners. It’s a loan, that can become a grant if certain requirements are met. It was designed to help businesses keep their employees on payroll.

Details: Interest is to be no more than 4% and the amount applicants receive is based on a calculation of average monthly payroll cost multiplied by 2.5, to cover two and a half months of payroll (including healthcare costs and paid sick leave) with a maximum loan amount of $10 million.

Who is Eligible? Small businesses, 501 c3 nonprofits with fewer than 500 employees, certain veterans organizations, sole proprietors, the self-employed, individual contractors.

Ready to Apply? If you are a small business owner this step-by-step guide will walk you through the process. If you are an independent contractor or sole proprietor use this guide. If you are a nonprofit use this guide.

—U.S. Chamber of Congress

Economic Injury Disaster Loans (EIDL): The CARES Act expanded the SBA’s long-standing EIDL program, which assists businesses, renters, and homeowners in regions affected by declared disasters.

Details: The SBA will provide initial EIDL loan disbursements of up to $15,000, in addition to a grant of up to $10,000 that does not have to be paid back if used on certain expenses. However, if a small business owner gets both an EIDL grant and a PPP loan, the forgiveness of the PPP loan would be reduced by the amount of the grant.

Who is Eligible? Businesses with fewer than 500 employees; cooperatives, ESOPs, and tribal small businesses with fewer than 500 employees; sole proprietors; independent contractors; and most private nonprofits.

Ready to Apply? If you are a small business owner this step-by-step guide will walk you through the process. If you are an independent contractor or sole proprietor use this guide.

Other New Federal Programs: In addition to loan programs, the CARES Act also expanded paid sick and family leave requirements and enacted a tax credit to provide further assistance to businesses.

Temporary Paid Leave and Family Medical Leave: The Families First Coronavirus Response Act created new temporary paid sick leave and paid Family and Medical Leave Act (FMLA) programs that are 100% reimbursable by the federal government. Check requirements, eligibility and exemptions using this guide.

Employee Retention Tax Credit: A 50% tax credit for the first $10,000 of compensation, including the employer portion of health benefits, for each eligible employee. Check eligibility and calculate your tax credit using this guide.

—U.S. Chamber of Congress

What Should a Small Business Owner Do Right Now?

Do your research and have a plan. Just because your business may be eligible for a loan, does not mean that’s the best decision for your business. Find the right loan for you, research it’s qualifications, and get your paperwork ready. SBA has simplified the process, but at minimum, business owners need to pull together average monthly payroll costs before going to a lender to apply.

—U.S. Chamber of Congress

What Else Should I Be Thinking About?

If you are applying for a PPP loan: If you know you can’t meet the requirements needed to get the PPP loan forgiven, evaluate the risk of taking on that debt. Be aware that if you reduce the number of employees after loan origination, you may get a reduced dollar amount in loan forgiveness.

If you’re considering laying off employees: Experts say it’s always risky to layoff employees, as there are many termination laws and hoops to jump through. The PPP loan program was created to allow businesses to avoid those risks by giving them tools to keep people on their payrolls.

If you are afraid you will not remain eligible for the loan: Experts say to make your best judgement call about the future. When normal commerce will resumes, will you be able to call employees back quickly and keep them on payroll? How will that cost affect your business?

Communicate! As you are working through making decisions for your business, be sure to communicate with your employees with as much transparency as possible. Get their opinions, and lead with empathy. Do the same with your customers.

—U.S. Chamber of Congress

The Chamber has created numerous resources to help businesses find and apply for the funding program that best meets their needs, including a number of how-to guides for federal programs. Plus, every week Chamber leaders are engaging directly with business owners through a variety of virtual events.

Path Forward: Every Monday and Thursday Chamber President Suzanne Clark leads a discussion with experts on the issues and challenges businesses face in reopening.

Workshop Wednesdays: Every Wednesday CO—by U.S. Chamber of Commerce hosts a virtual workshop for small business owners to share advice and answer questions during the COVID-19 crisis.

National Small Business Town Hall: Every Friday Co—by U.S. Chamber of Commerce, in partnership with Inc. hosts the Chamber’s Executive Vice President and Chief Policy Officer Neil Bradley to help small business owners navigate their funding options.

—U.S. Chamber of Congress